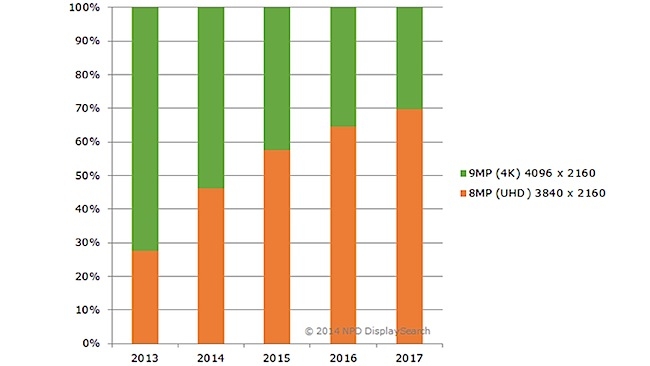

According to the latest NPD DisplaySearch Specialty Displays Report, global shipments of UHD 3840 x 2160 displays are forecast to grow at 69% through to 2017, while proper 4K 4096 x 2160 displays will only grow at 8%.

Why the disparity? Well it seems that the higher prices for 4K resolution screens are the main reason, NPD saying that the average selling price for a 31.5in UHD display in 2013 was $11,000, compared to a whopping $25,000 for a 31.1in 4K display.

What's more, it forecasts, if this continues 4K displays will end up with a declining share in the market.

“This trend toward UHD and away from 4K will continue, as long as the prices for 4K displays remain higher than one-and-a-half times the cost of UHD displays,” said Todd Fender, senior analyst of professional and commercial displays at NPD DisplaySearch. “If 4K resolution is not required, either for the slightly higher resolution or for the different aspect ratio, it will be difficult for buyers to justify the price premium.”

Away from the consumer market, global shipments of broadcast and production displays, including those used as field monitors, studio monitors, and large screen displays, exceeded 300,000 units in 2013. The current NPD forecast indicates that broadcast production display shipments will grow at just over 3% through 2017 too. A major contributor to this growth will be displays in the 30in-and-larger category, where shipments will more than double over the next four years.

The key market though is the 7.5in and smaller one. More than half of all broadcast and production displays shipped in 2013 were smaller than 7.5in and due to their relatively small screen size and lower specification requirements, many of these monitors use the same LCD panels that are found in tablet PCs.

All of which means that competition in the sector could be hotting up, which is pretty much good news for anyone that owns a camera.

“Since the tablet PC market has exploded in the last few years, price points are very low and panel availability is high,” Fender said. “As a result, there are frequent changes in core panel sizes, resolutions, specifications, and panel costs, due to rapidly changing consumer market demands, which may result in a fragmented market and low barrier to entry for newer, smaller brands coming into the category.”