Should you buy the new Mac Pro or an iMac?

Should you buy the new Mac Pro or an iMac?

iMacs are really powerful these days, and they come with a screen. The previous generation of Mac Pro's biggest selling point was that it was upgradable. The new Mac Pro isn't upgradable internally at all. Which should you buy? It's not an easy decision. This article by Chris Potter will help you through the decision process, and it will hopefully stop you making bad choices

Apple is set to release the much anticipated new Mac Pro at anytime now. We've been waiting a long-time for this, and it looks ready to set new benchmarks for innovative design and performance.

But, beneath the excitement, there is a big question creative business owners are going to struggle with. That question is whether they should invest in the new Mac Pro or purchase iMacs instead.

I'm going to suggest a framework for making that decision. Rather than focusing on the comparative specs of the hardware, I'm going to focus on the business aspects of the decision: how to evaluate which option will leave your business further ahead.

Situation Analysis

When looking at making a major investment, or any major business decision for that matter, the right starting point is to look at your current business model, your goals, and your strategy for achieving those goals.

So instead of immediately getting into the weeds deciding whether to purchase a Mac Pro or an iMacs, take a step back and start with the current position of your business. How is this purchase going to move your business forward?

One of the benefits of not working for a large corporation is that you don't have to spell out all of the stuff below in excruciating detail for an executive audience. It can be a quick back of the envelope analysis, but it's still worth thinking through these points to add some rigour to your decision making and ensure that you invest your scarce resources wisely.

Where Are You Now?

The starting point of examining your current situation is to look at your customers, your company capabilities, the competitive environment, and factors that may shift the market in the future.

Who are your target customers and what is the value proposition that you offer them? What are their value drivers and how are they changing? Are they going to be asking you to do different types of work in the future?

What are your current strengths? Do you have the necessary capabilities to meet the needs of your target customer now and in the future?

What is the competitive environment like right now? Is the nature of competition changing? If so, what will you need to do in order to adapt?

All of this should help you understand the basis of your competitive advantage and will prepare you to map out how your investment decision will help you achieve your business goals.

Where Do You Want to Be

This is really about looking at your business model and the vision of where you want to take your business. The rationale here is that any investment decision you undertake needs to support your ability to realize this vision. There must also be a realistic path to get from where you are today to where you want to go.

So now is a good time to think about how the kind of work you do is changing? Will you be hiring new staff? Are there new areas of the business that you want to move into? What new workflows do you hope to support? Is there new software that you need to run? Are you going to be spending more time doing colour correction, 3D graphics and other compute intensive operations? Where does 4k fit into your plans?

Answers to these questions about how you expect your business to change over the next couple of years will help determine what hardware is needed to support this vision.

If you are a small shop, maybe you need one very powerful computer that can do everything, so you don't waste time rendering. If you are a large facility with a number of suites, then maybe the answer will be to outfit suites with iMacs and use a couple of Mac Pros for heavy rendering as Biscardi Creative has done.

Define Your Decision Criteria

When making an investment decision, it makes sense to outline the criteria you are going to use to decide between your different alternatives. Doing this helps keep you honest by keeping you from tailoring your criteria to suit your preferred outcome.

These criteria are the explicit objectives that you hope to achieve through the purchase. In the case of hardware, factors would include the costs and financial benefits, but could also include other things like positioning your business to specialize in other types of work, improving employee satisfaction, and preparing your facility for future technology shifts like 4K workflows.

The previous steps of the analysis should make it pretty clear what your decision criteria should be.

Outline Your Options

You aren't making the decision about whether to buy a Mac Pro in a vacuum. Using an iMac is an obvious alternative, and for Avid and Adobe users, making a switch to a PC is another option. The one option we readily forget to consider is the do nothing option.

Say for example, in your situation an iMac meets your decision criteria better than a MacPro. That's great, but it's a good idea to weigh that against doing nothing. Perhaps the optimal solution is to just hold off and defer any purchase option.

The do nothing option is usually the least gratifying one for many of us who are tech inclined, but it may leave more money in your pocket for other investments like marketing, or in the case of sole proprietors, crazy things like paying yourself or taking a vacation.

Financial Analysis

Many of you probably won't build an actual financial model of buying a computer, but even if you aren't going to do the formal financial analysis, it's worth considering the different elements that would drive the model.

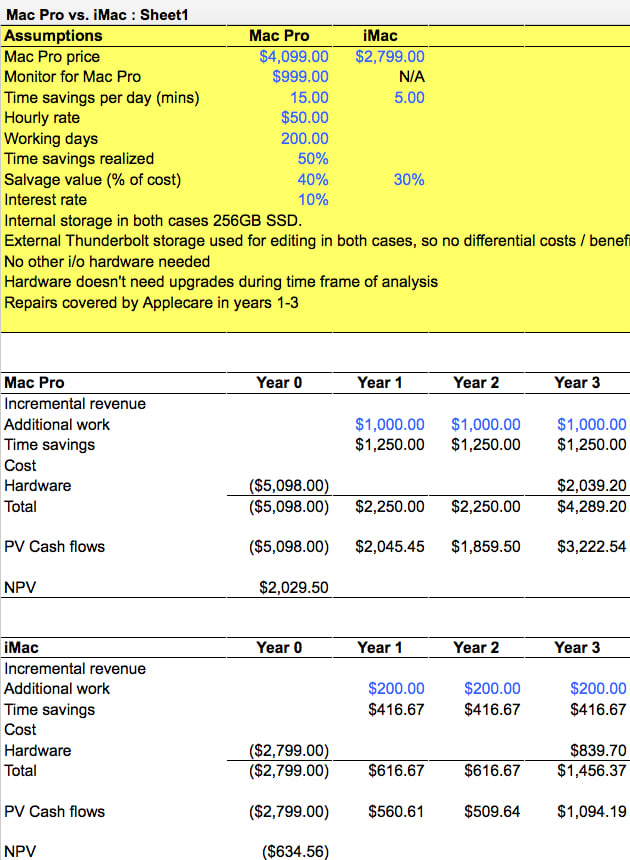

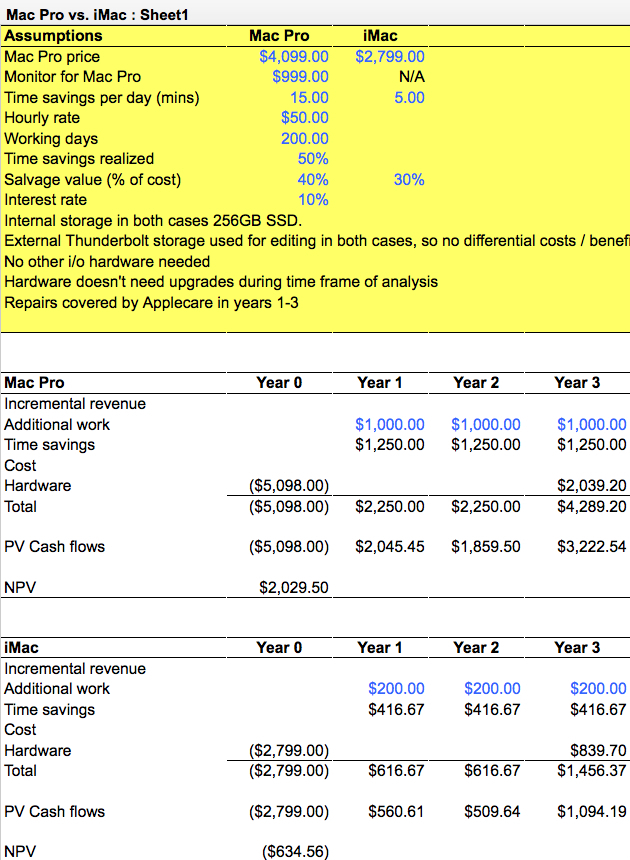

To get started, I would forecast the incremental cash flows associated with the different alternatives over a reasonable time horizon. In my example in the following section, I have assumed that we will use these computers for 3 years and then sell them so that we can buy something new.

In the case of the Mac Pro vs. the iMac, the main difference in revenues could include:

Revenue from work you wouldn't otherwise get with an iMac or a your current hardware. This could come from new jobs you can take on, the ability to do more jobs at once, the ability to do new types of work, the ability to command higher rates because you can do things you otherwise wouldn't have been able to do, etc.

Time savings associated with faster hardware. How much time will you save over the course of the year from using faster and more powerful hardware. For example, 20 minutes per day over 200 working days per year at a rate of $50 / hour would be about $3,333 per year. Of course, this time savings should only be included if it will be used for other productive work.

On the cost side of the equation, you really only need to compare hardware costs that differ between the scenarios under consideration. For example in looking at a decision between an iMac and a Mac Pro, I would assume that internal storage is essentially used for startup programs and that all media is on an external Thunderbolt RAID. Since the same external storage device is needed in both cases, I would omit it from my analysis.

Some add-ons like a monitor should be included in the price of the Mac Pro, as they are needed to build a complete system that compares with the all-in-one iMac. In the case of the Mac Pro this could add $999 for a Thunderbolt Display, to $3,200 for a 4K monitor. Of course, if a 4K monitor is necessary for your setup, then an iMac shouldn't be part of your consideration set anyway.

Other costs that can be taken into consideration include additional peripherals, support and maintenance costs, anticipated upgrades, and equipment replacement. For the sake of simplicity, I would assume that both setups have Apple Care, and that over the three year period of analysis won't require any additional maintenance.

One thing that can complicate the analysis is the projected lifespan of the equipment. It seems that there are a number of facilities still using Mac Pros that are 5+ years old, but you would probably be hard pressed to say the same thing about iMacs.

If you wanted to take lifespan into account, you could either look at things on a 3-year basis and estimate what you could sell each computer for and include that in the cash flow analysis, or you could look at things over something like 6 years (my optimistic estimate for the Mac Pro lifespan) and say that over the time frame you would have to buy two iMacs and that the first one would be sold for some salvage value.

If you really want to get rigorous about the analysis you would also want to include the depreciation tax shields associated with the different options, but that's beyond the scope of this blog post.

Once we have projected the cash flows for each option we need to discount them to account for the time value of money. Essentially a dollar earned a year from now has less value to you than a dollar earned today, so our analysis needs to reflect that.

Discounting the cash flows and then adding them up provides the Net Present Value (NPV) of the two alternatives. Comparing the financial benefit of the different options is easy once everything has been converted into today's dollars. The alternative with the greatest NPV is the one that does the best job of meeting the objectives of profit maximization.

Analysis

From what I have seen, it appears that the greater cost of a Mac Pro is more than offset by the greater earning potential due to time savings and new revenue streams.

In this case, investing in the Mac Pro is the preferred option because it yields a Net Present Value of $2030 versus $(635) for the iMac. The do nothing scenario, where no money is spent, and there are no additional revenue streams would have an NPV of $0 and would essentially be preferable to purchasing an iMac.

Of course, the challenge in all of this is trying to calculate incremental cash flows and put them down into a spreadsheet. It may be enough for you to forget about the modelling and just think through what the real costs and benefits will be with the different alternatives.

Evaluate Your Alternatives Based on the Decision Criteria

The previous section outlines how to look at which option wins on a straight financial basis. Now you should look at how your options stack up on the other broader criteria that you outlined as important.

For example, if you are running a facility, maybe this hardware will keep your editors happier, which creates a better working environment, and contributes to staff retention. Maybe this helps with attracting talent. These are real benefits that are worth factoring into your decision making.

The thing I want to emphasize here is that a rigorous decision making framework doesn't have to be completely finance driven, it just has to be tied to your business objectives, whatever they may be.

Congratulations

You've made it this far in the article, and you've made a decision in a pretty rigorous way. The next step is to decide whether to lease or buy, but that's the topic of another post.

For a more detailed version of this article visit Christ Potter's blog.

Tags: Business

Comments